Simple CT600 & Accounts Software

File iXBRL accounts to Companies House - CT600 corporation tax to HMRC

Not registered at Companies House? Click here

How It Works

From search to submission in minutes

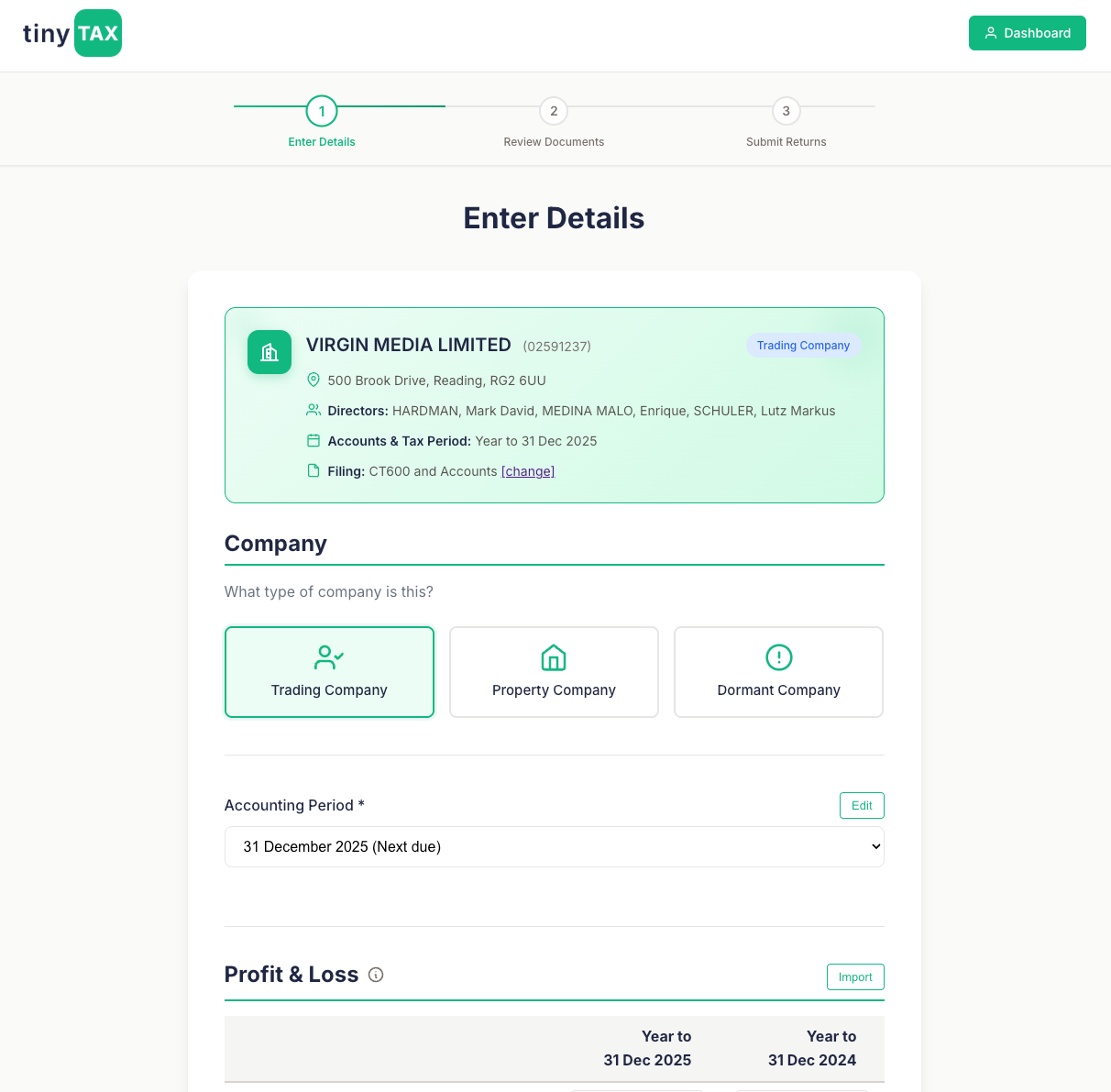

Enter Your Financial Data

Search for your company, select your accounting period, and enter your profit & loss and balance sheet figures. We pre-populate company details from Companies House.

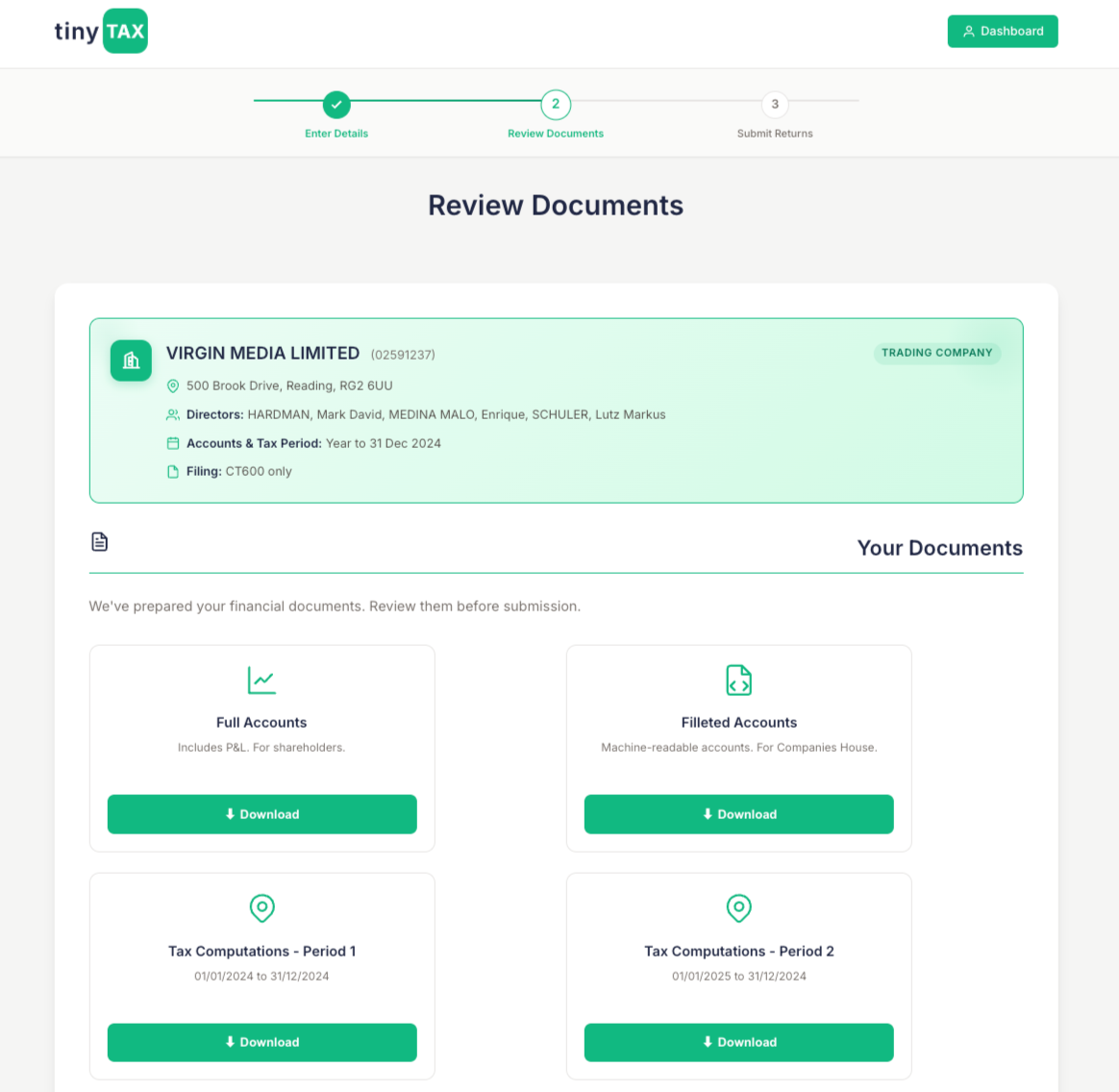

Review Your Documents

Preview your generated accounts and tax computations. See exactly how your corporation tax is calculated. We handle marginal relief, period splitting, and all the complex stuff automatically.

Submit to Authorities

Submit directly to Companies House and HMRC with one click. Track your submission status in real-time and download your filed documents for your records.

Loved by Small Businesses Across the UK

Join thousands of companies who've simplified their CT600 and accounts filing with TinyTax

Absolutely perfect and so easy to use! Importing from Xero made it a breeze.

Life SAVER literally. I was able finally to resolve those various codes and used your services today - it was sooo easy to use. Thank you so much for making this so affordable for outfits like ours.

When the Govt said they were closing their online facility and we had to use commercial software my blood ran cold. I found TinyTax and I can't believe how brilliant it is. This was the easiest HMRC CT600 and CoHo submissions I have ever had!

Was worried about the cost and hassle of software but tiny tax made it easy. Previously manually entering the figures into co house and hmrc took time but the entire process took less than 5 minutes.

I have been filing my returns for years through the Companies House and HMRC websites - I always dreaded it. This was the fastest and easiest submission ever. So much so that I look forward to the next fiscal year!

Simplicity, clarity, effectiveness.

It worked, first time, simple and solves a major issue in my business. Too small to require a full accountancy suite just to be able to file electronically.

"Tax doesn't have to be taxing" is now a reality. Great job TinyTax!

Tax used to be a hassle for me. I had to pay to file even though my company is super tiny. Tiny tax is a godsend for me.

Why Choose TinyTax?

File Your Way

File accounts only, CT600 only, or submit both to Companies House and HMRC in one go.

Quick & Simple

Pre-populated with Companies House data. Just add your figures and submit.

Secure & Compliant

Built to government specifications with proper authentication and secure handling.

More Happy. Tiny Tax.

Corporation tax returns shouldn't ruin your week. We've stripped away the jargon, automated the calculations, and made filing so fast you might actually enjoy it. Well, almost.

Built on Experience

TinyTax is Tim Fouracre's newest venture. After the cloud boom with Clear Books and the fintech wave with Countingup, he's now using AI for more happy, tiny tax.

Tim founded Clear Books in 2008. It provides simple accounting software to thousands of small businesses and was first to offer online VAT filings in the UK.

Tim founded Countingup in 2017. It provides business banking to over 100,000 UK small businesses and has processed over £10 billion in customer transactions.

Perfect for Accounting Firms

TinyTax streamlines the preparation and filing of micro-entity accounts and corporation tax returns for multiple clients.

Affordable annual plans from £20/year for dormant, more for trading companies

Manage all your clients in one place with ease

Import trial balances from Excel or CSV to auto-populate client returns

Manage your team

What does TinyTax cost?

TinyTax offers affordable annual plans starting from £20/year for dormant companies. For trading companies, we offer flexible plans - see our pricing page for current rates. Unlike other CT600 software that charges £100-200+ per year, TinyTax provides professional-grade tax and accounts filing at a fraction of the cost.

Can I file both accounts and CT600 with this software?

Absolutely. TinyTax handles dual submission - file your iXBRL accounts to Companies House and your CT600 corporation tax return to HMRC in one streamlined process. You don't need separate software for each filing, which saves you time and money.

Can I file just accounts or just CT600 separately?

Yes! TinyTax is completely flexible. You can file only your Companies House accounts, only your HMRC CT600 return, or both together - whatever you need. There's no requirement to file both simultaneously.

What's the alternative to HMRC's free CT600 service?

HMRC's free Corporation Tax online filing service is closing on 31 March 2026. TinyTax provides an affordable alternative with plans from £20/year for dormant companies and flexible options for trading companies. It handles both your CT600 and Companies House accounts in one platform.

Does this work for micro-entities and small businesses?

Yes, TinyTax is specifically designed for UK micro-entity limited companies and small businesses. If your company meets the micro-entity criteria (turnover under £1m, balance sheet under £500k, or under 10 employees), TinyTax provides everything you need.

Is the software HMRC and Companies House compliant?

Yes, TinyTax is fully compliant with HMRC and Companies House requirements. All submissions go directly through official government gateways.

Who is TinyTax designed for?

TinyTax is built for UK micro-entity limited companies. To qualify, your company must meet two of: turnover under £1m, balance sheet under £500k, or fewer than 10 employees. Perfect for freelancer companies, contractors, and single-director businesses. We don't currently support R&D credits, director's loans, group structures, or complex loss reliefs.

Ready to File?

Join thousands of businesses who've simplified their corporation tax filing with TinyTax.

Get Started